Price-based vesting - Powered by DIVA Protocol

By Walodja1987 at

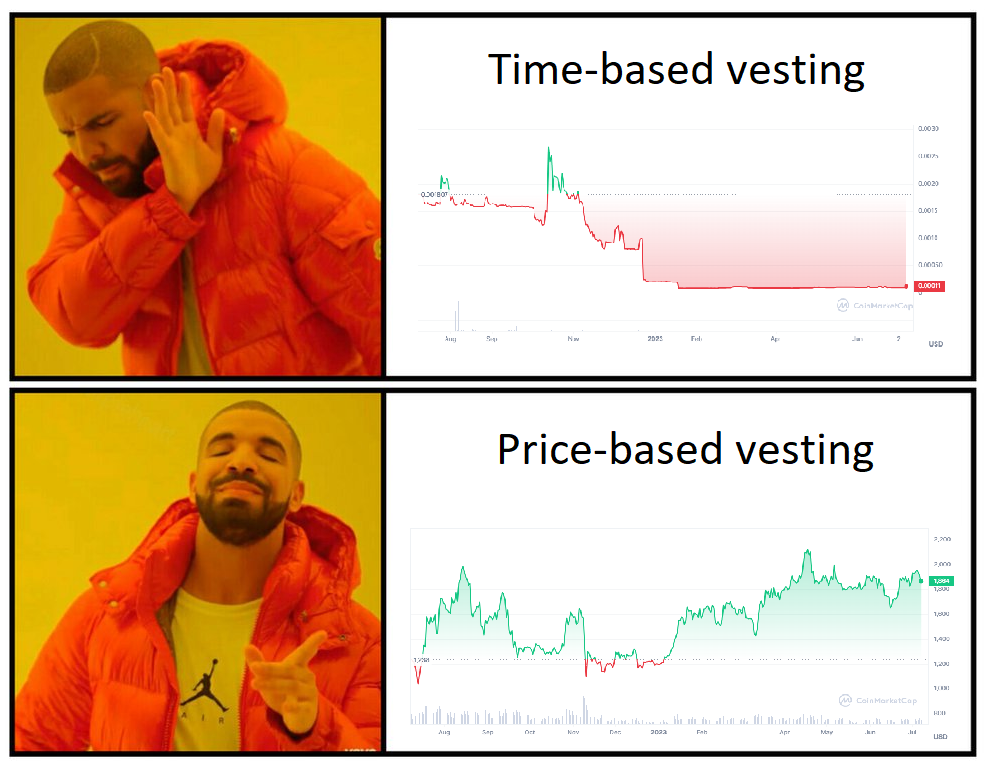

TLDR; this article presents a novel price-based vesting approach leveraging DIVA Protocol. The goal is to achieve a more balanced token market activity after listing and to improve the alignment of incentives among different project stakeholders.

Vesting has emerged as a crucial element in token distribution models, enabling the gradual release of investor and funding team token allocations over a predetermined period. The primary objective of vesting is to manage sell pressure in the market by spreading it out over an extended timeframe.

While time-based vesting appears sound in theory, it assumes that buy demand will sufficiently counterbalance increasing sell pressure over time. If a token fails to gain traction, the price will decline.

A more effective approach to vesting involves basing it on the project's token price. Under this model, tokens are unlocked only when the price surpasses a specific level. This means that sell demand becomes linked to realized buy demand. The unlocking process occurs at regular intervals, such as once a month, based on an oracle-reported outcome such as the average price during the designated period. Any unreleased tokens would automatically roll over for an additional month.

⚙️ Implementation

The implementation of a price-based vesting can be realized by a simple smart contract, referred to as “vesting contract” in the following, that interfaces with DIVA Protocol, a highly versatile smart contract-based system for creating and managing derivative contracts peer-to-peer.

The envisaged process is as follows:

- Funding: The vesting contract is funded with the project’s token.

- Specifying unlock conditions: The project team specifies the price-based payout conditions, observation period, and the oracle responsible for reporting the outcome (e.g., the existing integration with Tellor Protocol). These payout conditions can be static or dynamically adjusted over time following predetermined patterns.

- Token unlock: The vesting contract deposits the project tokens into the DIVA Protocol smart contract and releases the payout associated with the LONG side of the contingent pool - the side that benefits from an upward movement in the token's price - to the eligible parties upon price reporting by the oracle.

- Roll: Any unreleased payout, as represented by the SHORT side of the contingent pool, is re-deposited into DIVA Protocol and released in the same manner after the specified observation period. This process continues until there are no tokens remaining to roll.

A couple of technical considerations that are worth noting:

- As the eligible parties are not holding any SHORT or LONG position tokens directly, the issuance of new position tokens resulting from rolling unreleased tokens into a new contingent pool is not a problem.

- The parties eligible for payout claims can be stored within a mapping inside the vesting contract or derived based on the more gas-efficient approach of using Merkle proofs, particularly useful for a large number of participants.

- The rolling of the unreleased tokens into a new contingent pool may be triggered automatically when the first party claims their payout from the vesting contract.

- Payouts that remain unclaimed in one period will accrue to the next period.

✨ Key benefits

- Balanced market: The price-based vesting model ensures a more balanced and healthy token market by allowing tokens to be sold only after there is realized buy demand.

- Long-term oriented: By linking token unlockings to the token success, the price-based vesting model incentivizes project stakeholders to remain engaged and committed for the long term.

- Market maker protection: Price-based vesting provides protection against large token sell-offs, enabling a favorable environment for market makers, including liquidity providers in automated market makers (AMMs). This protection incentivizes market makers to offer increased liquidity, enhancing the overall market depth.

🪡 Risks

- Miscalibration: Tying payouts to overly ambitious price targets may result in no payout for project stakeholders. Careful consideration of achievable price levels is essential.

- Extended lock-up: Despite setting realistic price targets initially, a bear market can extend the lock-up period for tokens, keeping them locked for longer than anticipated. Incorporating a dynamic approach to the payout conditions may be used to respond to changing market conditions.

🌔 Conclusion

The adoption of a price-based vesting model represents an innovative and market-driven approach to token unlocking. By aligning incentives and fostering a sustainable ecosystem that grows in accordance with buy demand, this model promotes a balanced and healthy token market. We firmly believe that this use case holds significant potential for numerous projects seeking to enhance the alignment of incentives among project stakeholders and ensure a successful token launch.

🔗 Links

- 🌐 Website: divaprotocol.io/

- 🍏 Github: github.com/divaprotocol/diva-protocol-v1

- 📚 Docs: docs.divaprotocol.io/

- 🦜 Twitter: twitter.com/divaprotocol_io

- 🤖 Discord: discord.gg/8fAvUspmv3